T-Word Explains: What you need to know about the Energy Bills Discount Scheme

The government has announced a new “Energy Bills Discount Scheme” for UK businesses, charities, and the public sector starting from April.

A new energy scheme for businesses, charities, and the public sector was confirmed on the 9th of January, ahead of the current scheme ending in March. The new scheme will mean all eligible UK businesses and other non-domestic energy users will receive a discount on high energy bills until 31 March 2024.

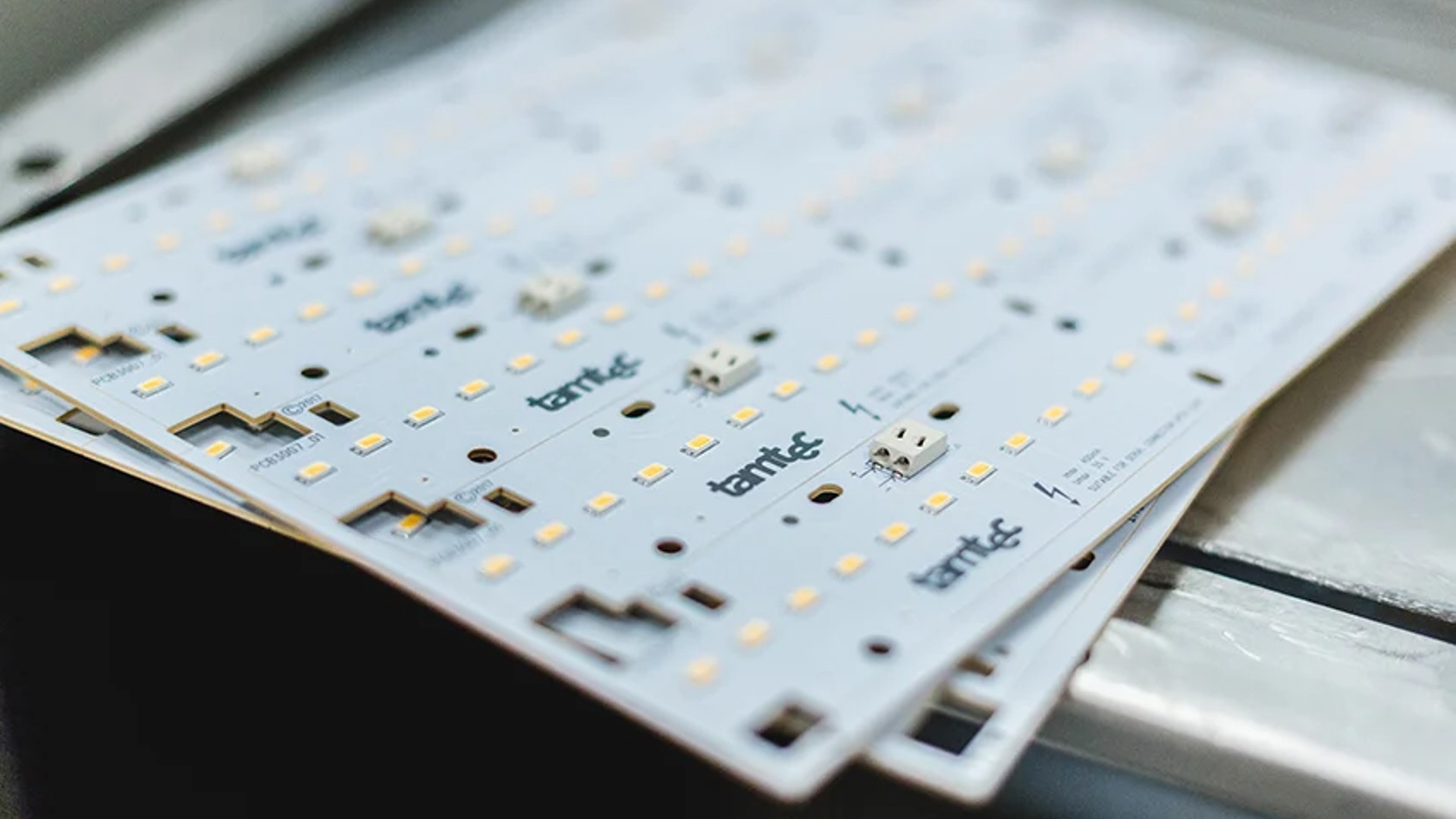

Of course, another, more long term solution to unnecessarily high energy usage and bills is to switch or upgrade to the latest LED lighting systems. If you require more information about how LED lighting can make sure you save, get in touch.

Learn more about the Government Scheme:

Energy Bill Discount Summary -

-

Scheme will provide a discount on high energy costs to give businesses certainty while limiting taxpayers’ exposure to volatile energy markets

-

Businesses in sectors with particularly high levels of energy use and trade intensity will receive a higher level of support.

For eligible non-domestic customers who have a contract with a licensed energy supplier, the government is announcing the following support:

- From 1 April 2023 to 31 March 2024, all eligible non-domestic customers who have a contract with a licensed energy supplier will see a unit discount of up to £6.97/MWh automatically applied to their gas bill and a unit discount of up to £19.61/MWh applied to their electricity bill.

- This will be subject to a wholesale price threshold, set with reference to the support provided for domestic consumers, of £107/MWh for gas and £302/MWh for electricity. This means that businesses experiencing energy costs below this level will not receive support.

- Customers do not need to apply for their discount. As with the current scheme, suppliers will automatically apply reductions to the bills of all eligible non-domestic customers.

For eligible Energy and Trade Intensive Industries, the government is announcing:

- These businesses will receive a discount reflecting the difference between a price threshold and the relevant wholesale price.

- The price threshold for the scheme will be £99/MWh for gas and £185/MWh for electricity.

- This discount will only apply to 70% of energy volumes and will be subject to a ‘maximum discount’ of £40.0/MWh for gas and £89.1/MWh for electricity.

Businesses in England will also benefit from support with their business rates bills worth £13.6 billion over the next five years, a UK-wide £2.4 billion fuel duty cut, a six month extension to the alcohol duty freeze and businesses with profits below £250,000 will be protected from the full corporation rate rise, with those making less than £50,000 – the vast majority of UK companies – not facing any corporation tax increase at all.

https://www.gov.uk/government/news/chancellor-unveils-new-energy-bills-discount-scheme-for-businesses